Mental Capacity & POA FAQ’s

Your decisions can be scrutinised by the Office of the Public Guardian (OPG), Social Services, neighbours, family members and creditors.

And you will sometimes doubt the decisions that you make.

Are you doing the right thing?

Powers of Attorney

What are Powers of Attorney?

Powers of Attorney are a legal way of giving those you trust the right to manage your affairs and make decisions if you become physically or mentally unable to do so. This could be because of a disability, unexpected illness or accident or just the onset of old age. Or it might just be that you are having difficulty getting around and want someone to be able to pop to the bank for you.

Powers of Attorney for now?

Some people experience unexpected life-changing events such as illness or an accident happens. This could mean that you’re left unable to make your own decisions and you’ll need someone to help you make financial or medical decisions or actions straight away.

Planning ahead just in case?

People make all sorts of «just in case» plans like having a spare tyre in the boot or break down cover. Many people like to plan ahead in case something happens to them in the future. This gives them the peace of mind that the right people are in place.

Help avoid difficult decisions and situations

Lots of people tell us why they don’t think they need a Power of Attorney. That they are married; that it’s expensive; complicated or family would just be able to make decisions should they need to. These are just some of the misconceptions around getting a Power of Attorney in place. The only way to ensure that your finances, care and medical arrangements are taken care of by someone you trust is to set up a Power of Attorney and its worth putting a plan in place early on.

Common types of Powers of Attorney

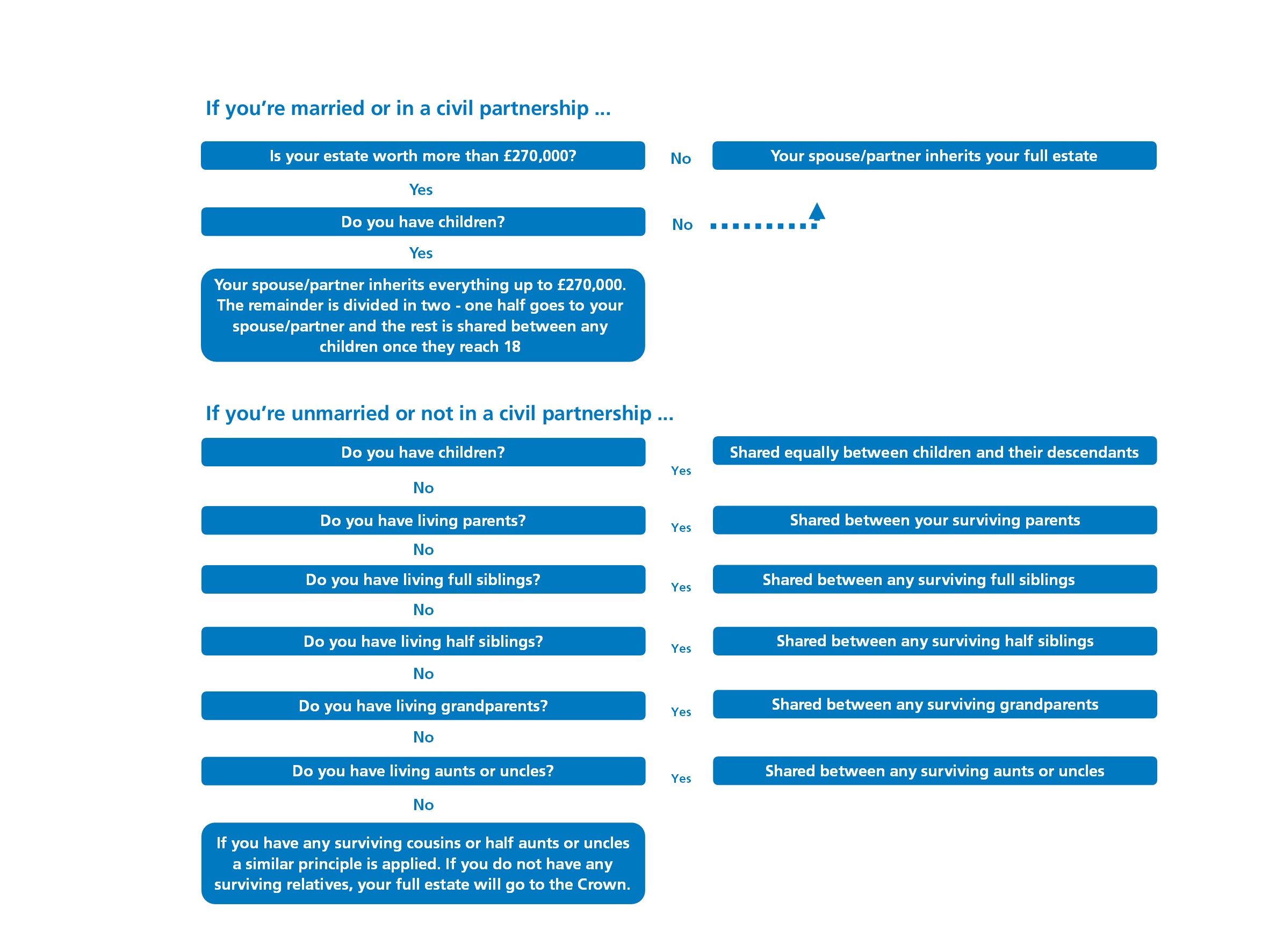

If you don't make a Will then...

- Your estate would be distributed according to strict rules based on legal and blood relationships and take no account of whether the relative(s) are known to you or are estranged from you./li>

- Your spouse may not receive the whole of your estate.

- Your unmarried partner will not inherit any part of your estate.

- If you are separated but not divorced your spouse will still be regarded as your next of kin.

- No provision can be made for friends or charities.

- The persons you would wish to administer your estate might not be entitled to do so.

- Inheritance Tax may be unnecessarily payable out of your estate.

Lasting Powers of Attorney - (LPA)

LPAs came into force on the 1st October 2007 and can be for general use or for a specific task. These are still valid if the donor loses their mental capacity, and can last for the rest of your life or until you cancel them. There are two different types available covering «Property and Financial Decisions» and «Health and Care». Important. A LPA cannot be used until it is registered with the Office of the Public Guardian. You can register the LPA at any time, (before or after someone loses their capacity) and the registration process takes around 2 months.

Enduring Power of Attorney - (EPA)

These were available until the 1st October 2007, when they were replaced by Lasting Powers of Attorney. EPAs signed by the Donor before that date are still valid, but if a Donor loses their mental capacity, then the Attorneys must stop using the EPA and register it with the Office of the Public Guardian before they can use it again. This registration process takes around 2 months.

Below are links to attachments issued by the OPG.

If you ever need advice on a specific problem then please Contact Us.

Mental Capacity & POA FAQ’s

If you or a loved one need a Power of Attorney putting in place, it can be an emotional and stressful time. Many of our clients have many questions about what will happen, what kind of service they really need and how it all works. Below are some frequently questions and answers that our clients ask us, that could help you. If you think of any questions that are missing, simply let us know by emailing ask@fidler.co.uk

What is a Power of Attorney?

Powers of Attorney are a legal way of giving those you trust the right to manage your affairs and make decisions if you become physically or mentally unable to do so. This could be because of a disability, unexpected illness or accident or just the onset of old age. Or it might just be that you are having difficulty getting around and want someone to be able to pop to the bank for you.

What is a Deputyship order?

What do I have to do if I am asked to be an Attorney?

How can I make sure I’m making the right decisions?

Do I need a Power of Attorney now?

When would I need a Power of Attorney in the future?

How could having Powers of Attorney make things easier in the future?

Lots of people tell us why they don’t think they need a Power of Attorney. They say that it’s expensive, complicated or their family would just be able to make decisions should they need to without a Power of Attorney. These are just some of the misconceptions around getting a Power of Attorney in place. The only way to ensure that your finances, care and medical arrangements are taken care of by someone you trust is to set up a Power of Attorney and its worth putting a plan in place.

We know that everyone’s situation and needs are individual to them so it’s always best to give us a call or book a meeting to talk through what is important to you and to discuss your needs.

What is a Living Will or an Advanced Decision?

Get in touch and we can discuss your individual situation and needs

We offer a free consultation and you can make an appointment to speak to us by calling 01623 45 11 11, emailing poa@fidler.co.uk, making an appointment in person at our offices, by video call or in the comfort of your own home.

If you ever need advice on a specific problem then please Contact Us.