Trusts

What exactly are they, and why would I need one?

Trusts are one of those things that many people have heard of but not many know what they actually are and what they are used for.

Need to Know

At its simplest, a trust involves one group of people (the trustees) looking after something (money or property for example) for another person or group of people (the beneficiaries). The Trustees owe a duty of care to the beneficiary(ies). That’s OK but it doesn’t tell you what they are actually used for and why you would want to have one.

Many people would think of trust funds, set up people by people with quite a bit of money, to ensure there is money for their children when they reach certain ages. However, that’s just one example of how and why a trust could be set up.

Trusts can be incredibly simple, or incredibly complicated. They might be used to protect an asset from possible future threats (see for example, again, our Asset Protection Trust factsheet), or be used to manage assets on behalf of someone who can’t manage the assets themselves (for example someone who is mentally incapable, or a child).

If you have a situation you feel a Trust would be suitable for, please give us a call for advice or use the link at the top of this page to get in touch.

To control and protect family assets

So for example you might want to give someone the right to live in a property but you don’t want them to be able to sell it – you could set up a trust to do this.

When someone is too young to handle their affairs

You aren’t legally allowed to own property until you are 18 so if you’ve been given it at a younger age then the property is normally held in trust until you are 18 (or 21 or whatever age is stated in the trust deed/Will)

When someone can't handle their affairs because they are incapacitated

A Trust deed allows someone else to take care of the administration of that person’s affairs – maybe drawing out housekeeping money. It can also be used for people who are on benefits where they have inherited some money and it is in danger of affecting their benefits. If the money is put into a trust fund so that they can’t get at it immediately then it can be excluded for the purposes of calculating the benefits.

To pass on money or property while you are still alive

This can be done for tax reasons – if you make a gift to your children whilst you are still alive then (provided you survive for the following 7 years) it will be excluded from your estate for the purposes of paying inheritance tax. However, you might not want to just hand the money over (you may be concerned about what your children might do with it!). In these circumstances, you could put the money into a trust fund. It has left your estate for tax purposes and the children will get it under whatever conditions you attach to the trust. Also see our Asset Protection Trust factsheet, which can be used to protect against future threats to your estate and property.

To pass on money or assets when you die under the terms of your Will - known as a 'Will trust'

This can be an age-related thing – preventing the children from getting the property until they reach (say) 25 or 30. It is also often used to benefit children by a previous relationship on your death (so for example you could let your spouse live in the family home but after she dies then your share of the property goes directly to your children from a previous marriage – this is just an example, but you can read more about Will Trusts.

Under the rules of inheritance that apply when someone dies without leaving a valid Will.

If you die without leaving a Will then the rules that govern how your property is split up (known as the rules of intestacy) will often involve creating trusts – usually to deal with people who are due to inherit something but aren’t yet 18.

Protecting your benefits if you receive compensation as a result of personal injury

If you die without leaving a Will then the rules that govern how your property is split up (known as the rules of intestacy) will often involve creating trusts – usually to deal with people who are due to inherit something but aren’t yet 18.

Declarations of Trust

What is a Declarations of Trust used for?

Declarations of Trust are used to protect interests in property that are not immediately obvious. There are dozens of examples for when they are used, but there are two that come up time and again:

1 – Protecting your Deposit when you are buying a house together:

A classic example is where two people buy a house together, maybe an unmarried couple, and one of them puts up the money for the deposit.

It’s difficult to think about, and no one wants to be so negative, but if you are buying a property with your partner:

- What if you have to sell the property because you are separating, or divorcing?

- What if one of you cannot go on the mortgage for credit reasons?

- What if something happens to one of you?

- What if the property is only going to be in one person’s name, and not the other person’s, maybe for tax or other reasons?

In each case, the person who has provided the deposit would naturally want it back. In the 2nd and 4th cases, the person not on the mortgage may not have a legal right to live in the property at all and can find themselves homeless and having lost their deposit monies.

Lots of people think a Will can cover this situation, but it does not. Lots of people think the divorce process will sort out any problems, but a lot of the time it doesn’t. Usually, unless there is evidence to the contrary, any sale proceeds from a property are split 50-50.

2 – Protecting your investment in your parents’ home:

Another common use is where parents are offered the opportunity to purchase their council-owned home under a right to buy scheme. Often parents cannot afford the cost themselves, so their children pay for the house.

This is potentially very risky for the children. What if the parents go into care? The property could be sold to pay for care fees, and if the children have actually bought the house with their own money they will need evidence of this otherwise they could lose their money.

The simple way to protect the unprotected money in both examples is by making a Declaration of Trust. The Trust states what will happen to the sale proceeds when and if the property is sold.

Let’s say Mr. Jones is buying a house with Miss Smith. He is putting down a 10% deposit of £10,000. If Mr. Jones and Miss Smith later split up, Mr. Smith may lose his £10,000. But if he creates a Declaration of Trust, protecting his money, he should get his £10,000 back when and if the property is sold and then any remaining equity in the property can be split equally between him and Miss Smith.

Declarations of Trust can be set up quickly and at very little expense, and give everyone peace of mind.

I’ve done a few blogs on Trusts, including “Watching the descendants for the wrong reasons“, “Nursing home fees“, and “Unregulated Will writers and property Will trusts“

Personal Injury Compensation Trust

This describes the situation where people get compensation for a personal injury and the money is received as a lump sum. This can cause problems that a trust can help to solve.

There is further information about Personal Injury matters elsewhere on our website. But a common problem occurs for people where they are on some kind of means-tested benefits. Suddenly receiving a lump sum of money can mean your benefits are stopped until you have used the money. The capital value of any award of personal injury compensation you receive will be taken into account when calculating your entitlement to those benefits. Even a small award of compensation could affect your benefits entitlement.

Even if you do not currently receive benefits, setting up a trust when you receive your award can prevent loss of any future benefits if your circumstances change.

You can also appoint professional people, such as Lawyers, to act as trustees. In the majority of cases the trust will end on your death and the remaining assets will be part of your estate and pass under the terms of your Will, but this is not always the case.

Trusts

Trusts are one of those things that many people have heard of, but not many know what they actually are. Its simplest description is that a Trust involves a group of people (the Trustees) looking after something (money or property for example) for another person or group of people (the beneficiaries).

Trusts are set up for many reasons – why would you need a Trust?

A Trust fund

Trusts can control and protect family assets

For example you might want to give someone the right to live in a property, but you don’t want them to be able to sell it. You could set up a Trust to make sure this does not happen.

If someone can’t handle their affairs because they are incapacitated

To pass on money or property when you are still alive

A Will Trust

A Will Trust means you can pass on money or assets when you die under the terms of your Will. This can be an age related thing such as preventing children getting property until they reach a certain age. It is also often used to benefit children by a previous relationship on your death (so for example you could let your spouse live in the family home but after she dies, then your share of the property goes directly to your children from a previous marriage.

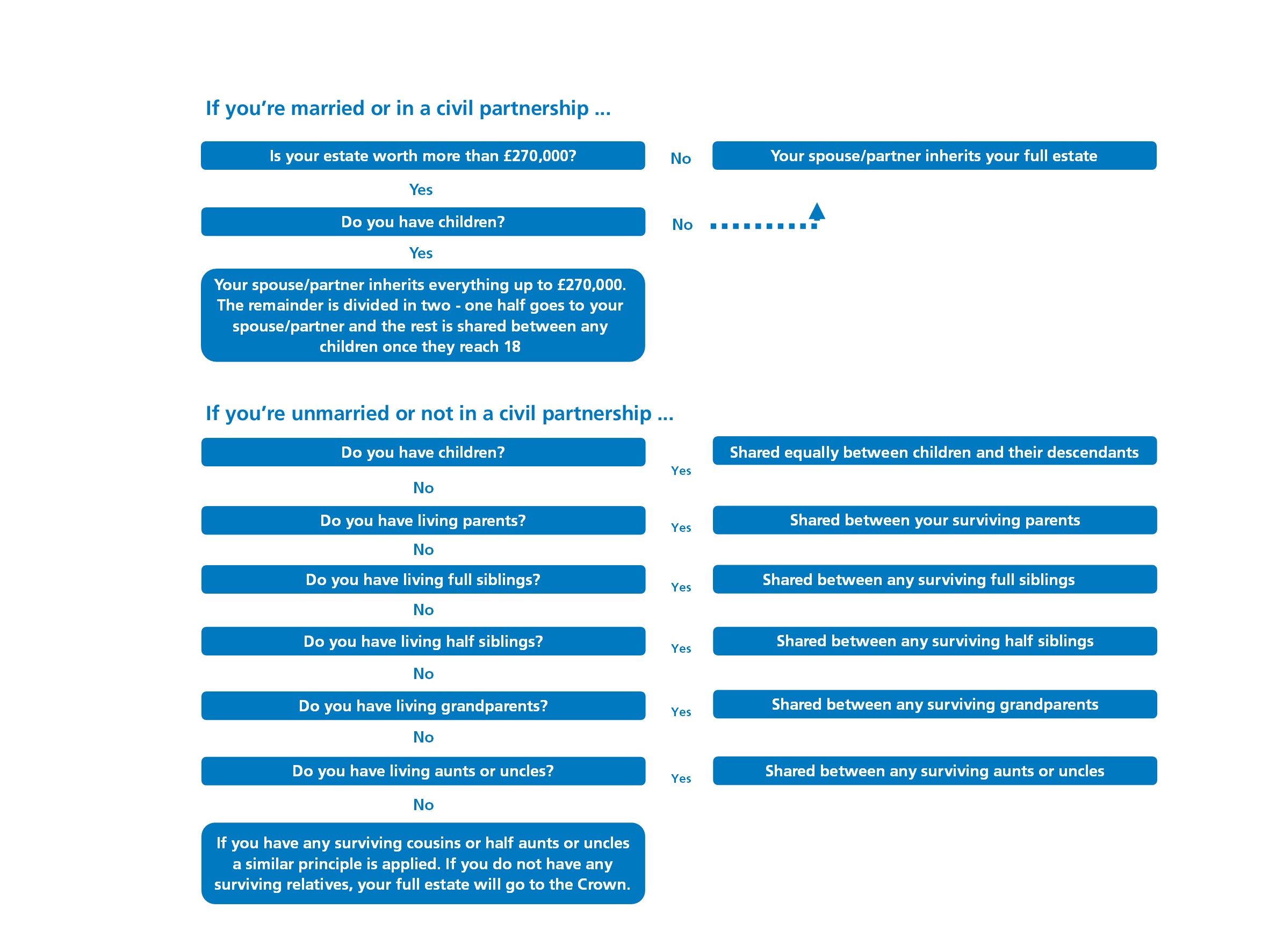

If there is no Will, how can you split an estate?

Protecting your benefits if you receive compensation as a result of a personal injury

What is a Declaration of Trust?

Declarations of Trust are used to protect interests in property that are not immediately obvious and prices start at £325 plus VAT. These are two examples that come up time and again:

Protecting your deposit when you buy a house together:

If you are buying a property with your partner (married or not), what would happen if you have to sell the property because you are separating, divorcing, if one of you cannot go on the mortgage for credit reasons, or if something happens to one of you? A Will would not cover this and the person who has provided the deposit (even if this is your parents) would naturally want it back.

Where parents have the opportunity to purchase their council-owned home under a right to buy scheme.

Often parents cannot afford the cost themselves, so their children pay for the house and this is potentially very risky for the children. What if the parents go into care? The property could be sold to pay for care fees, and if the children have actually bought the house with their own money, they will need evidence of this otherwise they could lose their money.

The simple way to protect the money in both examples is by making a Declaration of Trust. The Trust states what will happen to the sale proceeds when and if the property is sold. Declarations of Trust can be set up quickly and at very little expense, and give everyone peace of mind.

An Asset Protection Trust

An Asset Protection Trust is set up by you, for your benefit, whilst you are living, and for the benefit of your chosen beneficiaries after your death. The advantages of this are that the property and assets are agreed to and expectations of those who will benefit can be managed. In addition, can be managed assets in this type of Trust may be protected if you have to go into a nursing home, but you must take specialist advice on this.

Not sure which Trust is right for you? Don’t worry, we can help

Trusts can be incredibly simple, or complicated depending on your own individual circumstances. Trusts can be used to protect an asset from possible future threats or be used to manage assets on behalf of someone who can’t manage the assets themselves (for example someone who is mentally incapable, or a child). If you have a situation where you feel a Trust would be suitable for you and your family, please get in touch and speak to our specialist team.

Get in touch, we can help answer your questions

We offer a free consultation and you can make an appointment to speak to us by calling 01623 45 11 11, emailing trusts@fidler.co.uk, making an appointment in person at our offices, by video call or in the comfort of your own home.