Probate

This is such a sensitive area of law, and it creates very strong reactions.

There are also a lot of Chinese whispers about it, so we hope that this page clears some of that up.

This is intended as a very basic guide, and there is an awful lot more to this subject, so please contact us for specific advice, if you need it.

Probate – Everything you need to know…

When a person dies, someone needs to wrap up their affairs. Normally this involves gathering in their assets (e.g. getting money out of bank accounts, selling shares and property etc), paying off any outstanding debts, and then distributing the estate (if they left a Will it should be distributed according to that will; if not then there are rules that decide who should get what).

Personal Representatives (sometimes called “PRs”) are responsible for dealing with the affairs of the deceased (PRs are also known as Executors – if there was a Will; or Administrators – if there wasn’t a Will or if the original Executors names in the Will can’t act)

One of the first things that the PRs need to do is to obtain a Grant of Representation (that expression covers the situation with and without a will. If there was a Will then it’s known as a Grant of Probate; if no will then it’s called a Grant of Letters of Administration. The phrase Grant of Representation covers both)

The Grant of Representation is a sort of official certificate that says you are entitled to handle things on behalf of the deceased.

A Beginners Guide to Probate

– How exactly do you get a grant of probate?

If you want to know exactly what a grant of probate is and the difference between a Grant of Probate and a Grant of Letters of Administration then you need to look at our Probate FAQs. This section deals with the mechanics of getting Probate and what you do once you’ve got it.

Although this page is headed probate, you only get a Grant of Probate if the deceased died leaving a will; if they died without leaving a Will then it’s called a Grant of Letters of Administration (yes we know it’s a bit of a mouthful). Don’t be fooled by the word ‘grant’ – this has nothing to do with students – the grant being talked about is effectively a certificate that you are entitled to wind up the deceased person’s estate.

*On this page we will use the phrase “Grant of Representation” to cover both a Grant of Probate and a Grant of Letters of Administration.

Different types of Probate Service:

– How to obtain Probate more cost effectively

An awful lot of people steer away from using Lawyers if they need help with the Probate process. There are horror stories of incredibly expensive Lawyers, but not everyone charges in the same way.

We have several pricing options, which helps families to get the help they need, but gives them the flexibility to choose cheaper services if they are concerned about escalating costs.

Grant Only

First, we have a service where we will obtain the Grant of Probate or Letters of Administration for you, and then you can administer the estate yourself. We can do this via email, telephone, or face to face, and saves you having to potentially be interviewed at the Probate Registry if you attempt to do this privately.

We do this at a fixed fee which is agreed at the outset, and is usually around £500 plus VAT for our costs.

Full Administration of the Estate

We also do the ‘full service’, and completely administer the estate from start to finish, which includes where applicable:

- Obtaining clearance from HMRC

- Applying for the Grant of Probate or Letters of Administration

- Encashing the assets and settling liabilities

- Filing tax returns

- Creating estate accounts

- Distributing the assets

- Beginning administering trusts where applicable, including those hidden ones that aren’t always obvious from a Will

Some people really like this service, because it gives them peace of mind that everything has been done properly, and if anyone questions what has been done in several years time they will have proper documentation to answer any queries. It also means that you only have to sign a few forms, and we do all the hard work and chasing around.

This is priced depending on several factors such as the size of the estate.

The Middle Option

We also have services that are a little different to the two options above.

We can help with particular parts of an estate, for a fixed cost, so that clients can select exactly what they need, and know in advance exactly what it will cost.

For example, we have completed sets of estate accounts for clients who have dealt with everything themselves: obtained the Grant, closed all of the bank accounts, sold property, etc..

As the person responsible for administering the estate, you could be asked years in the future for evidence of how you administered the estate, and where all the money went. Estate Accounts are a simple set of documents detailing all the ins and outs, and if we prepare them for you it will be clear and meet the requirements of anything you may be asked to provide in the future.

We have also completed tax forms for clients for a fixed fee. Income tax returns are complicated enough, but completing them on behalf of someone else with limited information and slightly different rules can be difficult.

If you need help with an estate, please don’t be afraid to call for advice. It might be that we can help you with some short, free words of advice. But it might also be that we can help and take the pressure off you for cheaper than you might think.

Finally, I’ve also done a couple of blogs about this, including “Expensive Lawyers’ Costs for Probate”

FAQ’s

What actually is a Grant of Probate?

It’s basically a certificate indicating that you are the person that is entitled to wind up the deceased person’s estate (i.e. money, shares, property etc). Despite using the word ‘grant’ it has nothing to do with students or home improvements. It is obtained from the Probate Registry and is an official document that is recognised by banks, building societies, lawyers etc. as proof that you are entitled to deal with the estate.

What is a grant of letters of administration?

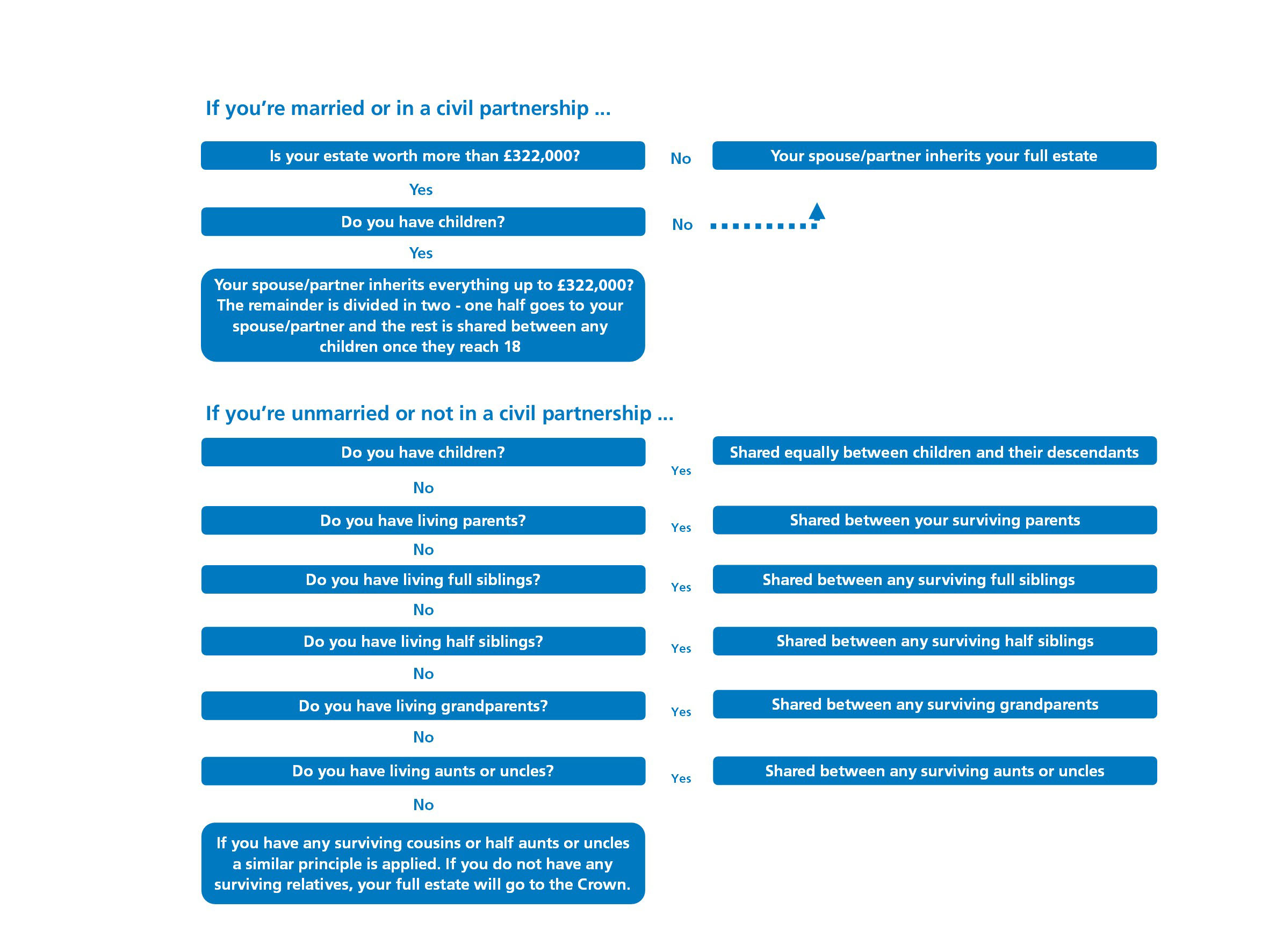

Exactly the same as a Grant of Probate, but it applies where the person died without making a will. If they died leaving a Will then it’s called Grant of Probate, if no Will then it’s a Grant of Letters of Administration. Yes, it is quite a mouthful. In these circumstances, there are also rules that state how the deceased’s estate needs to be split up (these are known as the rules of intestacy – because someone who dies without leaving a Will is said to have died ‘intestate’). You can use the expression Grant of Representation to cover either a Grant of Probate or a Grant of Letters of Administration.

Why do I need a Grant of Probate if there is a Will?

It’s really an extra security step. Potentially anyone could produce a document claiming it to be the last known Will of the deceased. Banks, Building societies etc. would then have to know if it’s a valid Will and so on. They wouldn’t know where to start with this. The Grant of Probate is issued by an independent body – the Probate Registry, so the banks, Building Societies etc. can rely upon it and let you draw the money out of the deceased’s bank accounts (for example).

I’m appointed as an Executor in a Will, and that person has now died. Do I have to fill out all the forms and do all the work myself?

Not if you don’t want to. An Executor’s role is voluntary. If you do not have the time, or simply find it too difficult to deal with, you can ‘renounce’ your role and allow others to take your place. Most Wills will name replacements to cover exactly this situation. But if not, parties who have sufficient interest in the deceased’s estate can apply for a Grant of Representation and administer the estate in your place. You can also appoint a Solicitor or other party to handle the estate on your behalf.

There is only a little bit of money in the bank. Do I need Probate?

A Grant is almost always needed when a person who dies leaves one or more of the following: stocks or shares certain insurance policies property or land held in their own name or as ‘tenants in common’ However, the rules for banks and building societies, etc. are less clear. Each institution has its own rules. Some banks will allow you to remove £20,000 from the deceased’s bank account by showing their death certificate, and by swearing on oath that you are the next of kin. But some banks will need a Grant of Probate for anything over £5,000.

How long will it all take?

Please see our Guide to Probate, but as you can see from the guide it is generally difficult to say. If we are applying to obtain a Grant of Representation, it usually takes around 4 weeks. If we are fully administering an estate, it can take days from the point of receiving the Grant, or years depending on the assets involved.

I had Power of Attorney. Do I need a Grant?

Any kind of Power of Attorney will end once the Donor of the Power of Attorney has died. So if you need some kind of Grant of Representation to deal with the deceased’s affairs, then you cannot use a Power of Attorney. You must apply for a different kind. Someone appointed under a Power of Attorney is not necessarily an Executor, and will not necessarily be able to obtain a Grant of Representation.

I'm being pursued to pay the funeral account, but I can't afford it and the Grant of Representation is still weeks away. What can I do?

If you give a copy of the funeral account to them, most banks will draw up a cheque payable to the funeral directors for you to pay the invoice.

What is Probate?

When a person dies, someone needs to settle their affairs. Normally this involves gathering in their assets (e.g. getting money out of bank accounts, selling shares and property etc), paying off any outstanding debts, and then distributing the estate. If they left a Will it should be distributed according to that Will and if not, there are rules that decide how their estate should be distributed.

Personal Representatives (sometimes called “PRs”) are responsible for dealing with the affairs of the deceased (PRs are also known as Executors if there was a Will or Administrators if there wasn’t a Will).

One of the first things that the PRs might need to do is to obtain a Grant of Representation which is an official certificate that says you are entitled to handle things on behalf of the person who died. For more detailed information about obtaining a Grant of Representation, read the information on what to do when someone dies’ or see or the Probate FAQ’s

Different types of Probate services

We offer different levels of Probate service with different pricing options which means that people can choose the right level of help to suit them with a cost that they are comfortable with.

Grant Only

First, we have a service where we will obtain the Grant of Probate or Letters of Administration for you, and then you can administer the estate yourself. We can do this via email, telephone, or face to face, and this saves you having to potentially be interviewed at the Probate Registry if you attempt to do this privately. We offer a fixed fee for this service which is agreed upfront and is usually around £950 + VAT.

Full Administration of the Estate

We also offer a ‘full service’, and completely administer the estate from start to finish, which includes where applicable:

- Applying for the Grant of Probate or Letters of Administration

- Encashing the assets and settling liabilities

- Filing tax returns

- Obtaining clearance from HMRC

- Creating estate accounts

- Distributing the assets

- Beginning administering Trusts where applicable, including those hidden ones that aren’t always obvious from a Will

The other option – where you choose the parts of Probate you need help with

We also offer a service where we can help with particular parts of an estate, for a fixed cost, so that clients can select exactly what they need, and know in advance exactly what it will cost. As the person responsible for administering the estate, you could be asked years in the future for evidence of how you administered the estate, and where all the money went.

Estate Accounts are a simple set of documents detailing all the ins and outs, and if we prepare them for you it will be clear and meet the requirements of anything you may be asked to provide in the future.

We can complete tax forms for clients for a fixed fee. Income tax returns are complicated enough, but completing them on behalf of someone else with limited information and slightly different rules can be difficult.

If you need help with an estate, please don’t be afraid to call for advice. It might be that we can help you with some free words of advice. But, it might also be that we can help and take the pressure off you for and it may be more reasonably priced than you thought.

Get in touch, we can help you with the Probate services you need

We offer a free consultation and you can make an appointment to speak to us by calling 01623 45 11 11, emailing probate@fidler.co.uk, making an appointment in person, at our offices, by video call or in the comfort of your own home.