Wills FAQ’s

Have you made your Will yet?

Your Will is one of the most important documents you are ever likely to put your name to and by instructing Fidler & Pepper to draw up your Will, you will have peace of mind that your affairs are to be looked after in a legal and professional manner. It costs far more to correct the mistakes in a homemade Will than it does to prepare a properly drawn up Will in the first place!

Q. Why make a Will at all?

A. Everyone should make a Will – even if they think that they have very little to leave. Without a Will, you cannot be sure that those who you wish to benefit after your death will do so

If you don't make a Will then...

- Your estate would be distributed according to strict rules based on legal and blood relationships and take no account of whether the relative(s) are known to you or are estranged from you.

- Your spouse may not receive the whole of your estate.

- Your unmarried partner will not inherit any part of your estate.

- If you are separated but not divorced your spouse will still be regarded as your next of kin.

- No provision can be made for friends or charities.

- The persons you would wish to administer your estate might not be entitled to do so.

- Inheritance Tax may be unnecessarily payable out of your estate.

If you do make a Will then...

- You decide how your family, friends and any charities should benefit.

- You can appoint guardians for your children and trustees to look after their inheritance until they are of age.

- You appoint whom you wish as executors to administer the estate.

- You decide your funeral arrangements.

- You may be able to reduce the tax payable on your death.

A Will is particularly important...

- To provide for young children.

- To provide for elderly or disabled beneficiaries.

- If you are separated or divorced.

- If you have remarried.

- If you have an unmarried partner.

Why use a solicitor?

- Don’t take chances with a DIY Will. Many homemade wills are defective and the costs and time dealing with the mistake are often much greater than the cost of a professionally written will.

- Fidler & Pepper are experienced in preparing Wills to cover all circumstances from simple wills with one beneficiary to complex wills designed to minimise tax or set up trusts.

Q. I’ve got a Will already – do I need to change it?

A. Do not assume that having made your Will you can then forget about it. Your Will may become out of date because of a change of circumstances and as time goes on it becomes more likely that your Will needs to be reviewed.

Marriage

Automatically cancels a Will unless it had expressly been made in contemplation of that marriage. Any children by a previous marriage or relationship can only be provided for by a new will.

Seperation

Does not affect a Will but it is sensible to consider a new Will at that time.

Divorce

Provisions for a former spouse are automatically cancelled but the remainder of the Will is still valid but should be reviewed.

Financial Circumstances

These may have changed. Your estate may have increased and be liable to Inheritance Tax which could be reduced by a new will.

Change of Assets

If you have disposed of any asset mentioned in a Will then the gift is of no effect.

Regular reviews

We generally recommend clients review their Wills (i.e. make a free appointment to come and see us) every 2-3 years unless something significant has happened in their lives before then

Q. What about my children?

A. Nobody likes to think about both parents not being there to bring up the children, but what if the unthinkable were to happen? Who would you wish to step in and be responsible for their day to daycare?

If you have children under 18

When you die, serious problems can arise if you haven’t made a proper provision for your children in your will. Without a Will, there are no specific rules as to who cares for your children. It is usually up to surviving family members to decide who take on this difficult role. But what happens if for some reason, those persons are not suitable or there is disagreement?

By making a proper Will:

- The choice of those you would wish to look after your children is made by you.

- Appointing a Guardian is done as part of your Will.

- You appoint Executors to administer your estate on behalf of your children. This ensures that your money is available to meet your children’s financial needs as they grow up, particularly in terms of education.

Without these instructions, resolving the serious problems as to who should administer the estate for the children’s benefit may cost considerable time and money.

Q. I’ve got disabled relatives – What about them?

A. Great care is needed if you need to provide for beneficiaries who are either physically or mentally disabled, or for people who receive certain kinds of benefits – particularly if they may need to go into care, are physically or mentally incapable of managing their affairs, or receive benefits which may be stopped.

There are a number of different options available:

Direct gift to the Benificiary

This may lead to loss of public funding (i.e. benefits they are currently claiming) and the benefit of the gift being largely wasted. If the beneficiary is mentally incapable of managing his or her affairs then someone may need to be appointed to take responsibility and this can be a complex and expensive process.

Gift to another relative on behalf of the disabled benificiary

You can leave the share intended for the disabled beneficiary to other relatives in the hope that they will support the beneficiary as necessary. However, there are a number of risks with this approach. For example, if the relative you have left the gift to gets divorced, or is made bankrupt, or even dies, then the gift could be used to pay off debts instead of supporting the real intended beneficiary. Not to mention the misuse of the monies.

Setting up a trust

The recommended approach is to place the share of your estate intended for the disabled beneficiary in a trust fund with trustees who can be members of the family appointed to use the funds to the benefit of the disabled beneficiary.~ It is quite possible to do this in a way that preserves the right to any means-tested benefits or funding and makes funds available for extra and additional expenditure which would not be covered by public funding or benefits.

Often in this way, it is possible to make generous provisions for a disabled beneficiary without any loss of capital or benefits. You can set up such a trust under your Will but it is a complex matter and great care has to be taken in the wording of the trust document to avoid it being challenged or contested, but once this is correctly done it can work incredibly simply and smoothly.

This is only a brief outline of a complex area and we are happy to discuss it in greater detail – to do so please email Richard Howard.

Q. Who will sort everything out for me?

A. So if you make a will, and decide what you want leave, who makes sure that everything you said in the Will actually gets done? Read on to find out.

Personal Representatives

Personal Representatives take responsibility for ensuring that the deceased’s assets pass to those who are entitled – this does not happen automatically. Personal Representatives can be relatives, a friend or your Lawyers or a combination of these. If there is a Will they are usually named as the Executors. If there is no Will they are referred to as the Administrators – but they do the same job.

Who can become an Administrator?

In the absence of a Will, the next of kin are entitled to apply to be Personal Representatives. This can lead to disagreements as to who should take on the responsibility and may not be the persons who the deceased would have wished. It is very important therefore to choose persons whom you would wish to sort out your affairs after your death.

The responsibilities of the Personal Representatives are to:

- Ascertain the value of the estate.

- Schedule all of the assets and obtain valuations. This includes bank and building society accounts, shares, cars, houses and any other investments.

- Obtain authority from the Probate Registry to administer the estate. Unless the estate is very small organisations will not actually hand over the deceased’s assets to the Personal Representatives without an official document from the Probate Registry of the High Court which confirms that the Personal Representatives are entitled to handle the affairs of the deceased. This official document is called the Grant of Representation (also known as the ‘Grant of Probate’ if there was a Will – if not then the document is called ‘Grant of Letters of Administration’).

- To swear an Oath explaining how they are entitled to act and giving a valuation of the estate

- If the estate exceeds £325,000 then the Inheritance Tax due must be paid before the Grant of Representation is issued.

- To distribute the estate to those who are entitled.

- Once the Personal Representatives have received the Grant of representation they can then get on with gathering together all of the deceased assets, paying any outstanding bills and then distributing the balance in accordance with the deceased’s Will or, if there was no will, in accordance with the rules on intestacy (i.e. if you die without leaving a will).

- To prepare accounts that show how the assets have been dealt with. All beneficiaries are entitled to see these accounts.

Often in this way, it is possible to make generous provisions for a disabled beneficiary without any loss of capital or benefits. You can set up such a trust under your Will but it is a complex matter and great care has to be taken in the wording of the trust document to avoid it being challenged or contested, but once this is correctly done it can work incredibly simply and smoothly.

This is only a brief outline of a complex area and we are happy to discuss it in greater detail – to do so please email Richard Howard.

Wills FAQ’s

Do you have questions about making the right Will for you?

Making your Will is one of the most important things you can do for your loved ones. Your Will details your personal wishes (individual to you) and it gives you the peace of mind that your loved ones will be looked after in the future. This lets you get on with enjoying the other important things in life.

Below are some frequently asked questions about Wills that may help you, but please get in touch with our team if you need to discuss your situation further.

Why do I need to make a Will?

Whether you are single, married, have children or not, own a property or rent – everyone should make a Will. You may think you have very little to leave, but if you think about your assets such as cars, jewellery, property and even sentimental objects, who would you choose for these to be passed on to? If you have children, you do need to have some plans in place for them, such as who would look after them and to make sure money you leave goes to them at the correct time.

Isn’t making a Will expensive?

Not usually. Our initial interview, whether it is in our offices, by phone call, video call, or even in your home, is free. There are times of the year where we make Wills in exchange for a donation to charity, and we have offers that run throughout the year. To find out the cost of Wills, take a look at our Wills pricelists.

What would happen if I died without a Will?

If you died without a Will a variety of things could happen:

- Without a Will you cannot be sure that those who you would choose to benefit after your death will be provided for as your estate would be distributed based on Government rules. This may include children from different relationships

- Your spouse or partner may not receive the whole of your estate

- Your unmarried partner will not inherit any part of your estate

- If you are separated, but not divorced your spouse will still be classified as your next of kin

- No part of your estate can be made for friends or charities

- Inheritance Tax may be unnecessarily payable out of your estate

What happens if I don’t have a Will?

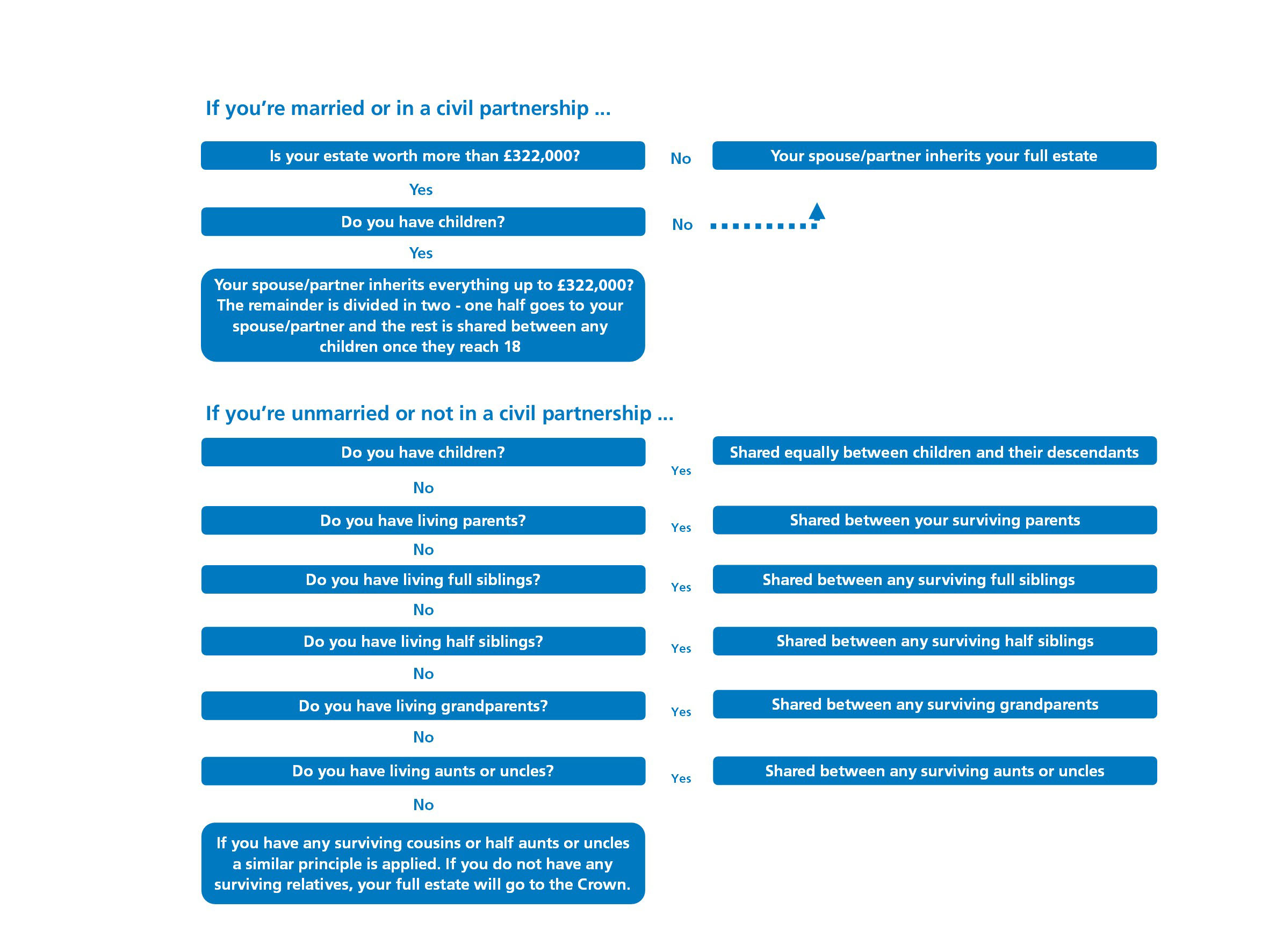

There are rules set out by the Government which you can see here

What are the benefits of making a Will?

- You decide how your family, friends and any charities should benefit

- You can appoint guardians for your children and trustees to look after their inheritance until they are of an age where they can responsibly access this

- You appoint Executors you trust to administer your estate

- You can decide your own funeral arrangements

- You may be able to reduce the tax payable on your death

- To make arrangements on who you would like to care for your pet

When is having a Will particularly important?

- To ensure that young children are cared for

- To provide for elderly or disabled beneficiaries

- If you are separated or divorced

- If you have remarried

- If you have an unmarried partner

- If you have children from different relationships

- If you have beneficiaries who are in care, or receive benefits, or have financial or relationship issues

How can a Will support my children if the worst should happen?

If you have children under 18 when you die, serious problems can happen if you don’t make provision for them in your Will

I’ve got disabled relatives, how can I make sure they are taken care of?

There are a number of different options available which should be discussed with someone experienced and regulated and qualified.

Why should I use someone experienced and regulated and qualified to make a Will?

I’ve got a Will already, do I need to change or update it?

We would recommend that you review your Will every 2-3 years in case your circumstances change as this will affect your Will. We offer a free review service too, as well as free storage of your Will.

These are some examples of why you would need to update your Will:

- Marriage automatically cancels a Will unless it had been made in contemplation of that marriage

- Any children by a previous marriage or relationship can only be provided for by a new Will

- Separation does not affect a Will but it is sensible to consider a new Will at that time

- Divorce means that your former spouse is automatically removed from the Will, and this can have surprising effects on your Wills and it should be reviewed

- If your financial circumstances have changed, you could be liable to Inheritance Tax which could be reduced by a new Will

Who will sort everything in my Will out for me?

Personal Representatives take responsibility for ensuring that the deceased’s assets pass to those who are entitled to them as this does not happen automatically. Personal Representatives can be relatives, a friend or your Lawyers or a combination of these. If there is a Will they are called Executors. If there is no Will they are referred to as the Administrators – but they do the same job. However, if you do not make a Will, other people and companies and organisations might have a say in who administers your Estate.

If I don’t have a Will, how will things get resolved?

You can make an appointment to speak to us about your circumstances by calling 01623 45 11 11, emailing wills@fidler.co.uk, making an appointment in person at our offices, by video call or in the comfort of your own home. We offer a free initial appointment for our Wills services and we will discuss the services and options that are best for you. Please be aware that for all home visits, we do charge an extra fee of £75.00 for 2 visits.